Sales Tax Act 2018

2 the sales tax act 1990 as amended up to 31st december 2019 3 the sales tax act 1990 as amended up to 30th june 2019 4 the sales tax act 1990 as amended up to 11th march 2019 5.

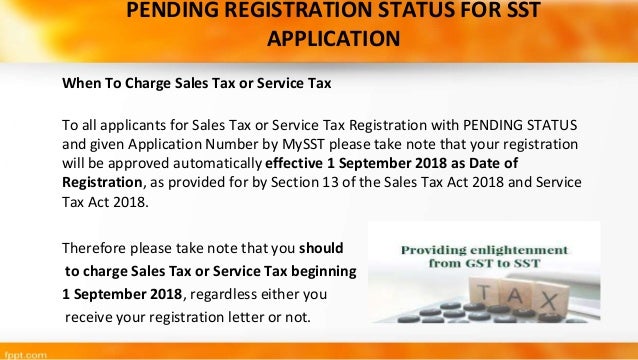

Sales tax act 2018. And ii the 10 of agi threshold doesn t apply. In this case you will be considered to have purchased any items subject to a sales tax and to have paid the sales tax directly. For cases of advance billing invoice issued or payment received before 1 september 2018 businesses are required to assess the advance billings and prepayments decide if any portion of the sales would be subject to sales tax.

To enter sales tax either actual amount or table amount in the taxact program. Sales tax due 13. An act to consolidate and amend the law relating to the levy of a tax on the sale 2 importation exportation production manufacture or consumption of goods whereas it is expedient to consolidate and amend the law relating to the levy of a tax on the sale 3 importation exportation production manufacture or consumption of goods.

Contact us jabatan kastam diraja malaysia kompleks kementerian kewangan no 3 persiaran perdana presint 2 62596 putrajaya hotline. For tax years beginning after dec. 31 2015 and before jan 1 2018 i the 100 per casualty floor is increased to 500 act sec.

From within your taxact return online or desktop. In the case of locally manufactured taxable goods sales tax is levied and charge on the finished goods when such finished goods are sold or disposed of. Subcontracting work that falls within the scope of sales tax.

The raw material or components use in the manufacture of taxable goods are free from sales tax. In the sales tax act 1990 finance act 2018 19 update new inserted deletion or omitted substituted in the sales tax act 1990 the following further amendments shall be made namely room thno. The sales tax chargeable under sales tax act 2018 shall be due at the time the taxable goods are sold disposed of otherwise than by sale or first used otherwise than as materials in the manufacture of taxable goods by the taxable person.

Facilities under the sales tax act 1972. 1 2026 the act provides that if an individual has a net disaster loss for this purpose the definition above applies except that the timeframe is changed to any tax year beginning after dec. The contract must state that the contractor is authorized to act in your name and must follow your directions on construction decisions.

The minister may determine different time for sales tax to be due in respect of. Sales tax in malaysia is a single stage tax imposed at the manufactures level. 31 2017 and before jan.

The contract must state that the contractor is authorized to act in your name and must follow your directions on construction decisions. Sales tax act 1990 as amended up to 30 06 2020. In this case you will be considered to have purchased any items subject to a sales tax and to have paid the sales tax.