Sales And Service Tax Act Malaysia

While rmcd has taken the initiative to ensure that all information contained in this guide is correct the rmcd will not be responsible for any mistakes and inaccuracies.

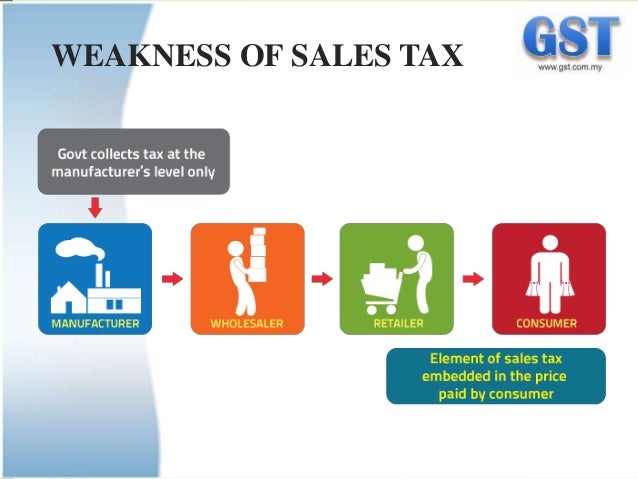

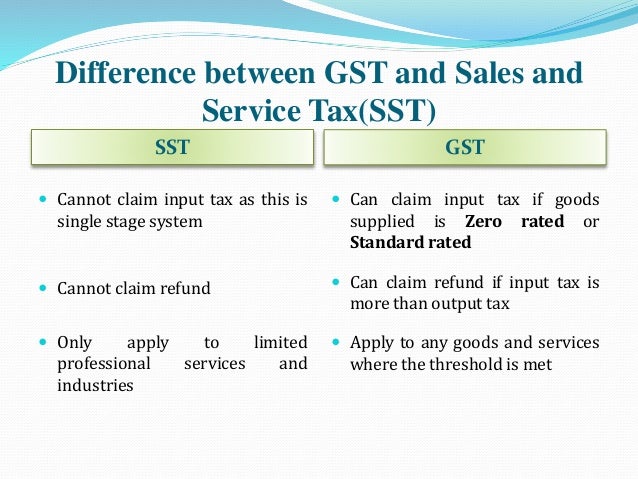

Sales and service tax act malaysia. The proposed rates of tax will 5 and 10 or a specific rate. Sec 8 1 sales tax act 2018 a tax to be known as sales tax shall be charged and levied on all taxable goods a manufactured in malaysia by a registered manufacturer and sold used or disposed of by him. Before the 6 gst that was implemented in 2015 malaysia levied a sales tax and a service tax.

In addition it is the duty of every taxable person to maintain full and true records of all transactions involving the sales of taxable goods. This page will help you to understand what sst. Persons exempted under sales tax persons exempted from payment of tax order 2018.

Special designated areas that include langkawi island tioman island and labuan island are exempted from the service tax. Contact us jabatan kastam diraja malaysia kompleks kementerian kewangan no 3 persiaran perdana presint 2 62596 putrajaya hotline. Manufactured goods exported would not be subject to sales tax.

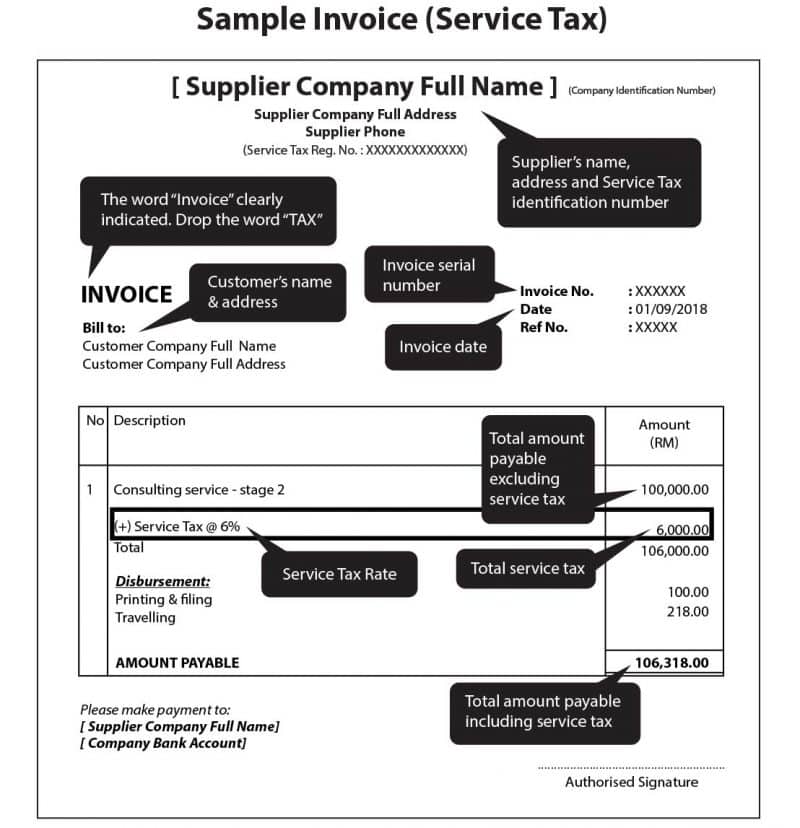

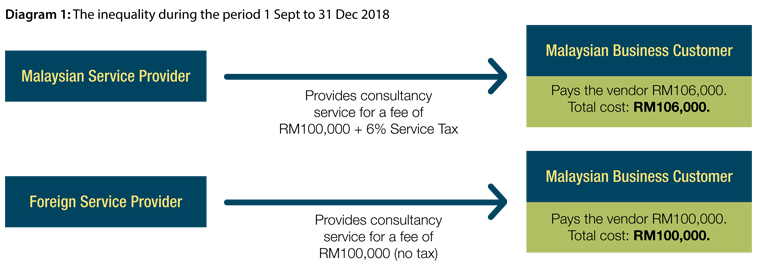

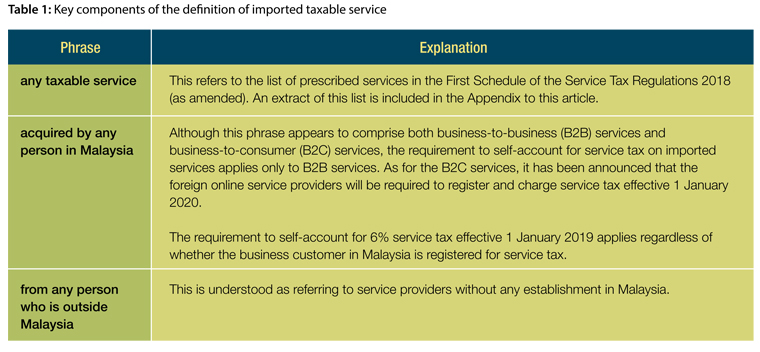

The sales tax act 1972 also makes provisions for the production of invoices by computer. Under the new sales tax and service tax framework announced on 16 july 2018 sales tax is levied on the production of taxable goods in malaysia and the importation of taxable goods into malaysia at a rate of 5 or 10 or a fixed percentage depending on the category of goods. These are some of the following taxable service that is subjected to service tax 6 flat tax.

Such records or books of accounts must be maintained in romanised malay or in english. When any services are sold out sst malaysia tax is applied that is 6 percent. Sales tax sales tax is charged on taxable goods that are manufactured in or imported into malaysia.

Iii sales tax will be imposed at the rate of 5 10 or a specific rate for petroleum products and the service tax will be at the rate of 6. Following the announcement of the re introduction of sales and services tax sst that will kick start on 1 september 2018 the royal malaysian customs department rmcd has recently announced the implementation framework of sst as well as a detailed faqs to arm malaysians with sufficient knowledge of the new tax regime before sst commence. If records or books of accounts are kept in a language other than in romanised malay or in english the senior officer of sales tax may request a translation be provided at the.

Governed by the sales tax act 2018 and the service tax act 2018 the sales tax was a federal consumption tax imposed on a wide variety of goods while the service tax was levied on customers who consumed certain taxable services. Or b imported into malaysia by any person. Scope charge sales tax is not charged on.

Hotel insurance club gaming telecommunication legal accounting architectural security etc in the course of furtherance of business in malaysia and is liable to be registered or is registered under the service tax act 2018. Treatment under sales tax and services tax legislations and aims to provide a better general understanding of taxpayers tax obligations.