Rpgt Malaysia 2017 Rate

Br1m to continue focus on strengthening the economy.

Rpgt malaysia 2017 rate. As mentioned earlier the government has tinkered around with rpgt rates a few times over the last decade or so largely in an effort to curb speculation and property flipping. Good news is 0 rpgt rate for the properties over 5 years was kept as it is. In the 6 th and subsequent years.

Malaysia budget 2017 is looming up and there are already signs in the market that significant changes are coming along. It was suspended temporarily in 2008 2009 and reintroduced in 2010. Hence it ll encourage some market activity.

Based on the real property gain tax act. These proposals will not become law until their enactment which is expected to be in early 2017 and may be amended in the course of its passage through parliament. Since 2014 though rpgt rates have remained the same.

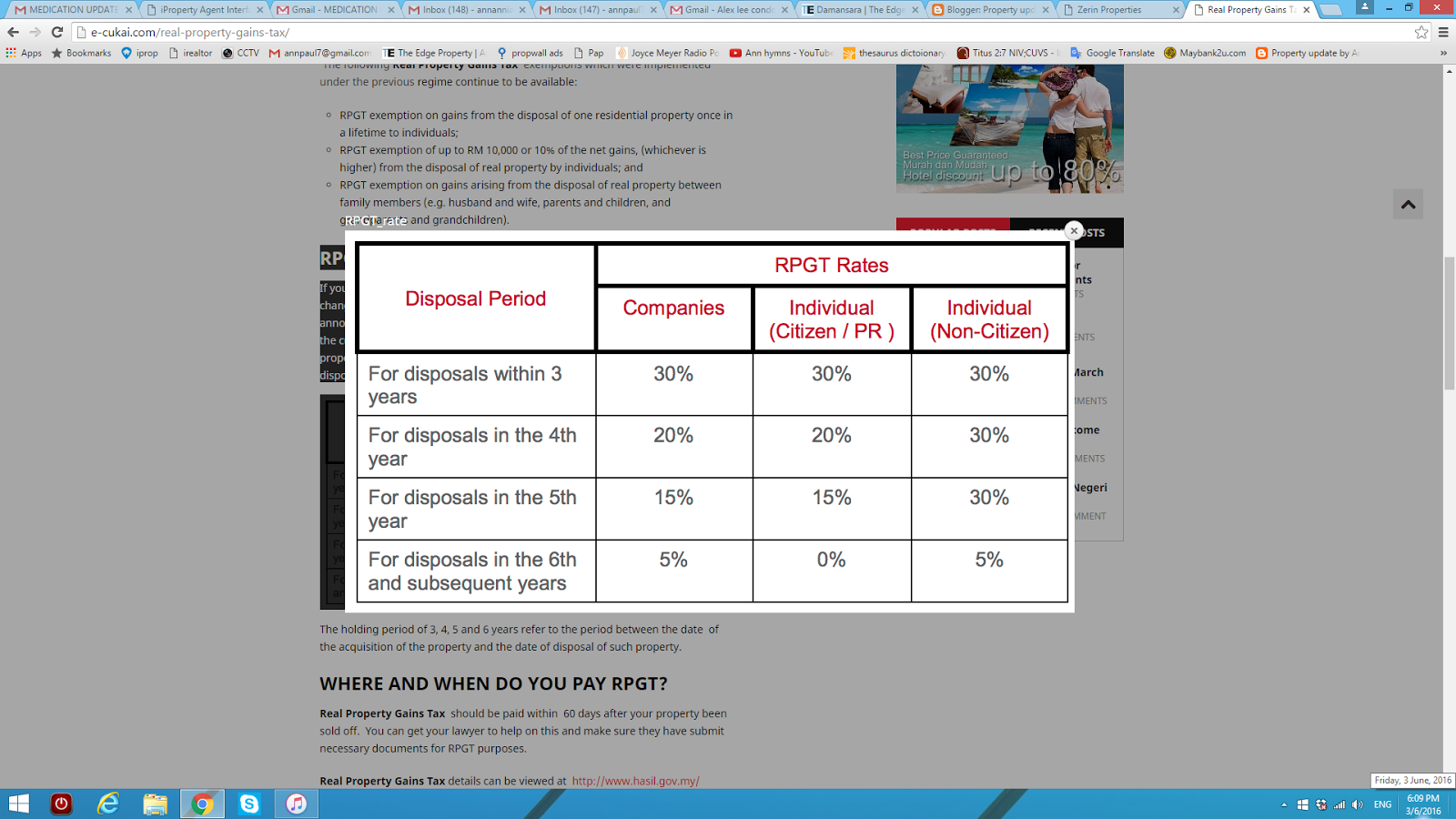

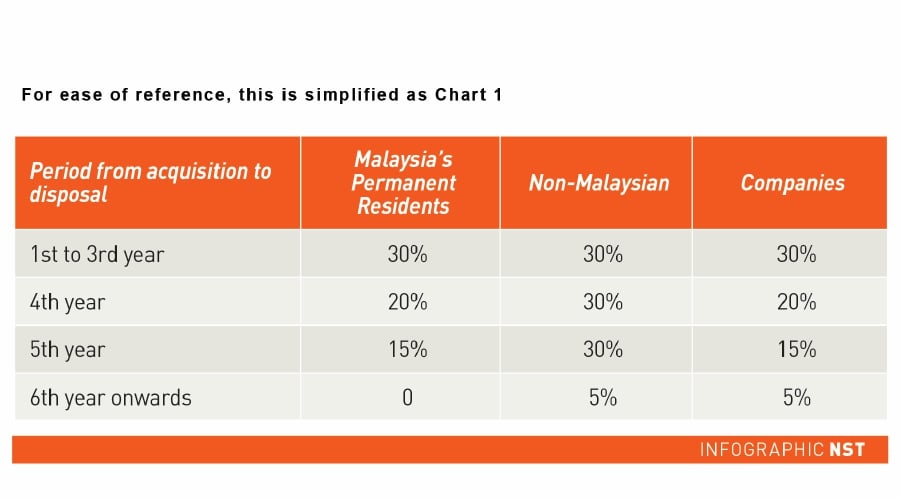

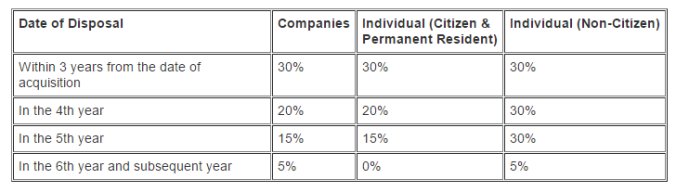

Rpgt rates in 2016 and 2017. In the announcement of budget 2014 every property owners have to pay rpgt at a 30 for properties sold within 3 years or less 20 for properties disposed within 4 years and 15 for properties disposed in 5 years. Above rpgt rates in malaysia as of budget 2014.

Rpgt payable net chargeable gain x rpgt rate. Pay your tax now or you will be barred from travelling oversea. In the 5 th year.

He adds that this will benefit the secondary market. Real property gains tax rpgt is a tax chargeable on the profit gained from the disposal of a property and is payable to the inland revenue board. Receive your br1m payment directly in bank account.

This booklet incorporates in coloured italics the 2017 malaysian budget proposals announced on 21 october 2016. Rpgt rm 250 000 x rpgt rate the rpgt rate that applies depends on a number of factors which i ll elaborate on below. Real property gains tax rpgt in malaysia.

The main factors that determine which rpgt rate apply to you are. Companies trustee 1 individuals individuals 2 and executor of deceased estate 2 companies 2 within 3 years. The statutory reserve requirement srr ratio was reduced from 4 to 3 5 in january 2016 epf contributors were given the option to reduce their compulsory contributions from 12 to 8 in february 2016 and the overnight policy rate opr was reduced by 0 25 in july 2016.

Aside from upgraders it s also good for investors because they can cash out and change to something else. Rpgt rm120 000 x 5 rm6 000 as you can see jared saved rm16 500. As such rpgt is only applicable to a seller.

According to the edge the malaysian institute of estate agents miea immediate past president eric lim shared that by moving the base year property owners will be able to sell and upgrade. 10 citizens and permanent residents 1 company incorporated in malaysia or a trustee of a trust w e f the date the relevant law comes. All br1m up increased.

Since rpgt is charged upon a gain from disposal it is important to first determine when the acquisition and disposal actually happened at what consideration both events were completed and whether a loss or gain was made. Check your br1m application result now. This booklet is intended to provide a general guide to the subject matter and should not be regarded as a basis for.

Items exempted from rpgt. For individual seller if your sale and purchase agreement is dated on 1 january 2017 then the date on the new slae and purchase agreement is dated 31 march 2020 when you disposed your property then the year of disposal will be considered as fourth year and rpgt rate will be 20.